Current assets to equity ratio

Posted in: Financial statement analysis (explanations)

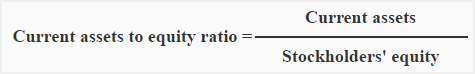

Current assets to equity ratio (also known as current assets to proprietors’ fund ratio) shows the stockholders’ funds invested in current assets. The ratio may be expressed in proportion or percentage.

Formula:

Example:

For example, suppose a company has current assets valuing $650,000 and stockholders’ equity $4,500,000. The current assets to equity ratio would be computed as follows:

= $650,000 / $4,500,000

= 0.14 or 14%

Significance and interpretation:

There is no norm, the ratio varies from industry to industry. Like fixed assets to equity ratio, it is used as a complementary ratio to proprietary ratio.

Leave a comment