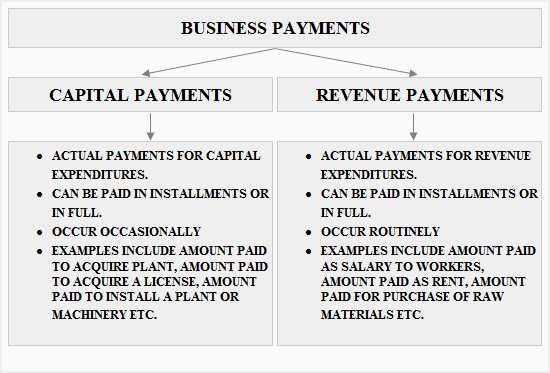

Capital and revenue payments

Capital and revenue payments are two different types of business payments. Business payments differ from business expenditures in the sense that they are actual payments in cash of the company’s recorded expenses. They may be paid in installments or in full depending on the company’s policies.

Capital payments

Capital payments and capital expenditures are interrelated. Capital expenditures are business expenditures the benefit of which is enjoyed for at least more than one financial year and also which are non-recurring in nature. Capital payments are actual payments in cash of the capital expenditures incurred by the company. The payment(s) may either be in installments or paid fully once and for all.

Example

BCD company bought a manufacturing plant to increase its production capacity. The vendor sent a team of professionals with the plant to install it inside the company’s premises. After installation, company was invoiced with an amount of $2,500,000 the next day. BCD Company capitalized the plant with the said amount in its books and paid the capital payments in installments of $500,000 monthly to the vendor.

Some other examples of capital payments

- Amount paid to acquire a warehouse in order to store more inventory.

- Amount paid through banking channel in order to acquire a license of making a particular well marketed drug.

- An oil and gas company paid $3,000,000 to buy exploration rights from the government.

Revenue payments

Revenue payments and revenue expenditures are interrelated. Revenue payments are actual payments in cash of the recorded revenue expenditures. They are recurring in nature and include the payments of the day-to-day expenses of the company.

Example

FGH company purchased raw materials from its approved supplier for $20,000. The supplier supplied the raw materials to the company and invoiced them with the said amount. The company paid 50% of the invoice to the supplier and agreed to pay the remaining 50% in the coming two months.

In the above example, the invoice of $20,000 is revenue expenditure and the 50% amount paid upfront and the remaining 50% to be given in the 2 months are revenue payments.

Some other examples of revenue payments

- Salary paid to the employees at the end of the month.

- Payments made to a stationary shop for purchase for printer pages, staplers and highlighters.

- Rent paid on a warehouse rented by the company.

Summary and conclusion:

- Capital payments are actual payments in cash for the capital expenditures incurred by the business; they can either be paid in installments or in full.

- Revenue payments are actual payments in cash for the revenue expenditures incurred by the business; they can either be paid in installments or in full.

- Capital and revenue payments should never be confused with one another as it can lead to classification errors and result in an incorrect financial summary report.

Leave a comment