Business entity concept

Definition and explanation

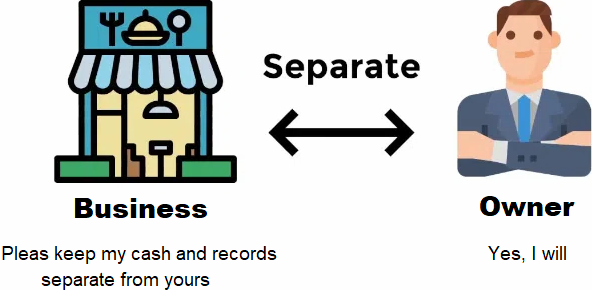

The business entity concept (also known as the separate entity and economic entity concept) states that the transactions related to a business must be recorded separately from those of its owners and any other business entity. In other words, while recording transactions in a business, we take into account only those events that affect that particular business entity; the events that affect anyone else other than the entity are not relevant and are therefore not included in the accounting records of the entity.

This concept is very important because if the transactions of a business are mixed up with those of its owner or another business, the accounting information would lose its usefulness.

The business entity concept is applicable to all types of business organizations (i.e., sole proprietorship, partnership, and corporation), even if a law does not recognize a business and its owner as separate entities.

Importance/need of business entity concept

The business entity concept of accounting is of great importance because of the following reasons:

- The business entity concept is essential to separately measuring the performance of a particular business in terms of its profitability and cash flows.

- It helps in assessing the financial position of each and every business separately on a particular date.

- It becomes difficult and impossible to audit the records of a business if they are intermingled with those of different entities or individuals.

- The concept ensures that each and every business entity is taxed separately.

- The employment of business entity concept is very common among business organizations. If a company ignores this concept, it will not be able to compare its financial performance with that of others in the industry.

Examples

A few examples of the application of the business entity concept are given below:

Example 1:

Mr. John has acquired the floor of a building with three halls for $1,500 per month. He uses two halls for his business and one for personal purposes. According to the business entity concept, only $1,000 (the rent of two halls) is a valid expense for the business.

Example 2:

The owner of a company lends a loan to his own company. It would be strictly recorded as the company’s liability, and that has to be paid back to the owner.

Example 3:

Mr. Sam owns a company. He uses two different credit cards: one for the payment of business expenses and one for the payment of personal expenses. He pays $200 for the electricity bill for his company using his personal credit card. According to the business entity concept of accounting, the electricity bill for the business should have been paid using the company’s credit card. The payment of $200 using a personal credit card would therefore be considered a contribution of additional capital by Sam.

Leave a comment