Balance sheet

The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular date. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. While the balance sheet can be prepared at any time, it is mostly prepared at the end of the accounting period.

Most of the information about assets, liabilities, and owners’ equity items is obtained from the adjusted trial balance of the company. However, retained earnings, a part of the owners’ equity section, is provided by the statement of retained earnings.

Sections of the balance sheet

We can broadly divide a balance sheet into three sections: the assets section, the liabilities section, and the owners’ equity section. Each of these sections is briefly discussed below:

Assets section

In this section all the resources (i.e., assets) of the business are listed. In the balance sheet, assets having similar characteristics are grouped together. The mostly adopted approach is to divide assets into current assets and non-current assets. Current assets include cash and all assets that can be converted into cash or are expected to be consumed within a short period of time – usually one year. Examples of current assets include cash, cash equivalents, accounts receivable, prepaid expenses, advance payments, short-term investments, and inventories.

All assets that are not listed as current assets are grouped as non-current assets. A common characteristic of such assets is that they continue providing benefit for a long period of time – usually more than one year. Examples of such assets include long-term investments, equipment, plant and machinery, land and buildings, and intangible assets.

When a balance sheet is prepared, the current assets are listed first and non-current assets are listed later.

Liabilities section

Liabilities are obligations to parties other than owners of the business. They are grouped as current liabilities and long-term liabilities in the balance sheet. Current liabilities are the obligations that are expected to be met within a period of one year by using current assets of the business or by the provision of goods or services. All liabilities that are not current liabilities are considered long-term liabilities.

Owners’ equity section

Owners’ equity is the obligation of the business to its owners. The term owners’ equity is mostly used in the balance sheet of sole proprietorship and partnership form of business. In a company’s balance sheet, the term owners’ equity is often replaced by the term stockholders’ equity.

When the balance sheet is prepared, the liabilities section is presented first and the owners’ equity section is presented later.

Format of the balance sheet

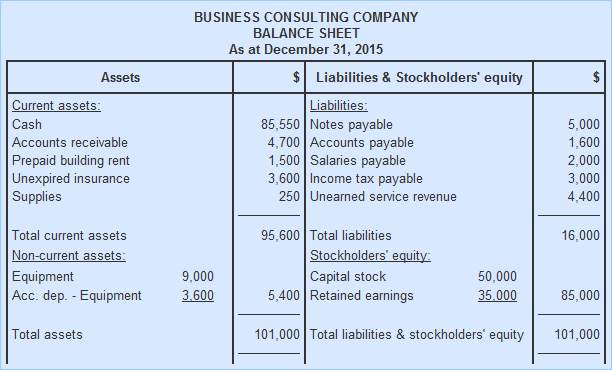

There are two formats of presenting assets, liabilities, and owners’ equity in the balance sheet: the account format and the report format. In account format, the balance sheet is divided into left and right sides like a T account. The assets are listed on the left-hand side, whereas both liabilities and owners’ equity are listed on the right-hand side of the balance sheet. If all the elements of the balance sheet are correctly listed, the total of the asset side (i.e., the left side) must be equal to the total of liabilities and the owners’ equity side (i.e., the right side).

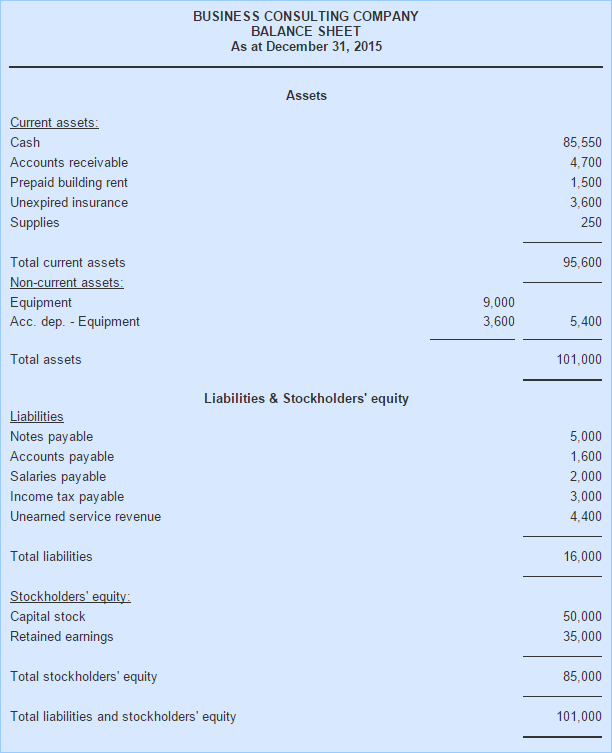

In report format, the balance sheet elements are presented vertically, i.e., the assets section is presented at the top, and the liabilities and owners equity sections are presented below the assets section.

The example given below shows both formats.

Example

Using the information from the adjusted trial balance given on this page and the statement of retained earnings given on this page, we can prepare the balance sheet of Business Consulting Company as follows:

Account format:

Report format:

Usefulness of balance sheet

As described at the start of this article, a balance sheet is prepared to disclose the financial position of the company at a particular point in time. This information is of great importance for all concerned parties. For example, investors and creditors use it to evaluate the capital structure, liquidity, and solvency position of the business. On the basis of such evaluation, they anticipate the future performance of the company in terms of profitability and cash flows and make important economic decisions.

Limitations of balance sheet

Major limitations of balance sheet are listed below:

- Many items in the business have great financial value and may be important for the users of financial statements in making reliable decisions. However, they are not reported in the balance sheet because they cannot be objectively measured. Examples of such items include the skill and knowledge of employees in an IT firm, a sound customer base, a high reputation, etc.

- The current fair value of various assets and liabilities may be important for some decision makers, but the balance sheet does not disclose it because assets and liabilities are mostly reported at their historical costs.

- The value of some items is reported in the balance sheet on the basis of judgments and estimates. For example, the depreciation is usually calculated on the basis of the estimated life of the assets. The book value reported in the balance sheet is therefore also an estimated value. Another example is the accounts receivable that are reported at their estimated net realizable value.

Excellent Summary

Balance sheets format

Could you please tell me what is the applicability of balance sheet?

It really makes sense and also gives us more understanding thank u ma /sir.

Well presented for anyone to understand the accounting concepts.

I want correct answer

find them yourself

It’s so fantastic. Thanks alot dear

This Explanation is very important for me, I thank you.

thank you sir/mam .

Accounting for life