Average collection period

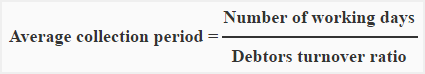

Average collection period is computed by dividing the number of working days for a given period (usually an accounting year) by receivables turnover ratio. It is expressed in days and is an indication of the quality of receivables.

Formula

Example

Following data have been extracted from the books of accounts of PQR Ltd.

- Total sales: $176,000

- Cash sales: $77,000

- Accounts receivables – (closing): $8,000

- Notes receivables – (closing): $3,000

Compute average collection period for PQR Ltd.

Solution

360* /9**

= 40 days

On average, the PQR limited have to wait for 40 days before the receivables are collected.

*Assumed number of working days in a year.

**Receivables turnover ratio has been calculated as follows:

Net credit sales / Receivables + Notes receivables

= $99,000 / $8,000 + $3,000

= $99,000 /$11,000

= 9 times

(The denominator consists of closing balances of accounts receivable and notes receivable because opening balances of these accounts are unknown and the average cannot be worked out)

Computation of credit sales:

= $176,000 – $77,000

= $99,000

Significance and Interpretation:

Like receivables turnover ratio, average collection period is of significant importance when used in conjunction with liquidity ratios.

A short collection period means prompt collection and better management of receivables. A longer collection period may negatively affect the short-term debt paying ability of the business in the eyes of analysts.

Whether a collection period is good or bad, depends on the credit terms allowed by the company. For example, if the average collection period of a company is 50 days and the company allows credit terms of 40 days then the average collection period is worrisome. On the other hand, if the company’s credit terms are 60 days then the average collection period of 50 days would be considered very good.

Leave a comment