Adjusted trial balance

The preparation of the adjusted trial balance is the sixth step of the accounting cycle. This trial balance is prepared after taking into account all the adjusting entries prepared in the previous step of the accounting cycle. The main purpose of preparing an adjusted trial balance is to adjust the balances of ledger accounts so that they can provide correct information to complete the next steps of the accounting cycle (i.e., preparation of financial statements).

In addition to being a tool for checking the mathematical accuracy of books of accounts, an adjusted trial balance provides enough information for the preparation of a number of mandatory financial statements, such as the income statement, balance sheet, and statement of changes in equity. The preparation of the statement of cash flows, however, requires a lot of additional information.

Financial statements drawn on the basis of this version of trial balance generally comply with major accounting frameworks, like GAAP and IFRS.

Adjusted trial balance is not a part of financial statements; rather, it is a statement or source document for internal use. It is mostly helpful in situations where financial statements are manually prepared. If the organization is using some kind of accounting software, the bookkeeper or accountant just needs to pass the journal entries (including adjusting entries). The software automatically adjusts and updates the relevant ledger accounts and generates financial statements for the use of various stakeholders.

Format and methods of preparing adjusted trial balance

The format of an adjusted trial balance is similar to that of an unadjusted trial balance. It has three columns. The first column is used to write account names or account titles; the second column is used to write debit amounts; and the third column is used to write credit amounts. The adjusted trial balance is prepared using one of the two methods explained below:

First method – inclusion of adjusting entries into ledger accounts:

The first method is similar to the preparation of an unadjusted trial balance. However, this time the ledger accounts are first updated and adjusted for the end-of-period adjusting entries, and then account balances are listed to prepare the adjusted trial balance. This method is time consuming but is considered more systematic. It is usually used by large companies where a lot of adjusting entries are prepared at the end of each accounting period.

Second method – inclusion of adjusting entries directly into unadjusted trail balance:

The second method is simple and fast but is considered less systematic. This method is usually used by small companies where only a few adjusting entries are found at the end of the accounting period. In this method, the adjusting entries are directly incorporated into the unadjusted trial balance to convert it to an adjusted trial balance. Both methods are in practice and produce the same result.

To exemplify the procedure of preparing an adjusted trial balance, we shall take an unadjusted trial balance and convert the same into an adjusted trial balance by incorporating some adjusting entries into it. To simplify the procedure, we shall use the second method in our example.

Example:

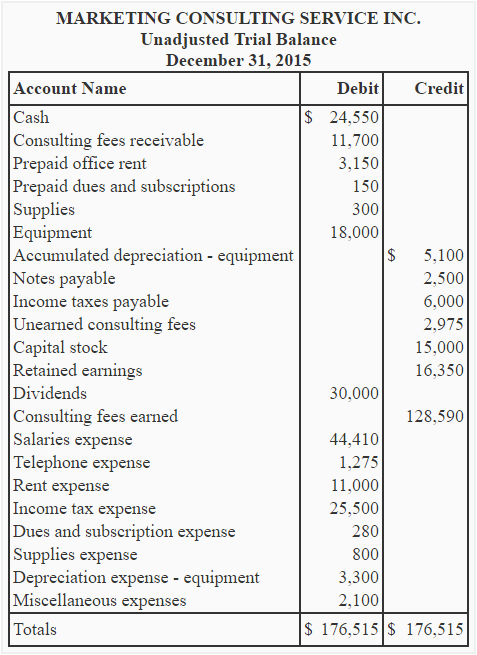

Marketing Consulting Service Inc. adjusts its ledger accounts at the end of each month. The unadjusted trial balance on December 31, 2015, and adjusting entries for the month of December are given below.

Unadjusted trial balance:

The adjusting entries for the first 11 months of the year 2015 have already been made.

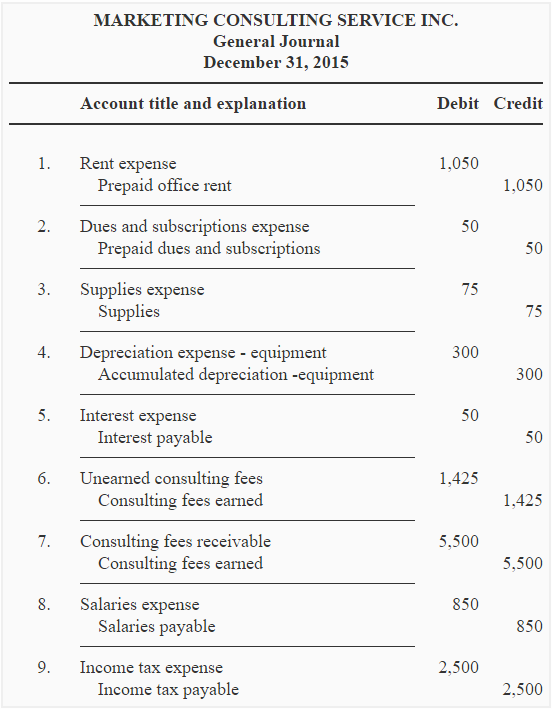

Adjusting entries:

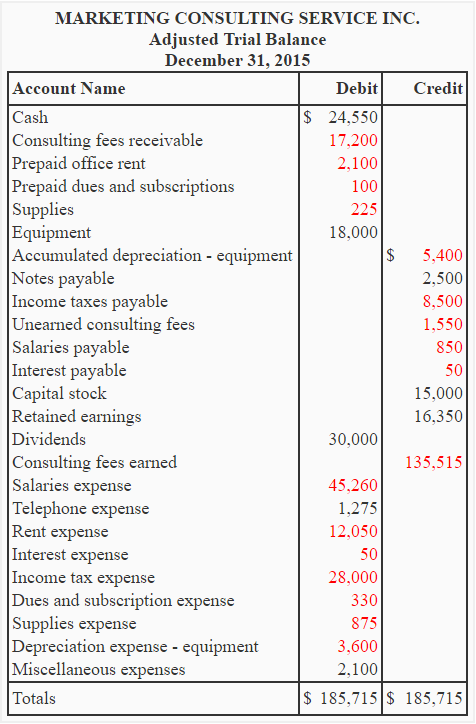

Required: Prepare an adjusted trial balance of Marketing Consulting Service Inc. on December 31, 2015.

Solution

The accounts that have been affected because of adjusting entries for the month of December are shown in red font in the adjusted trial balance. It is just for the purpose of explanation, and you don’t need to change the color of account titles in your homework assignments or examination questions.

Thanks these was very helpful

Thank you very much for the information. I appreciate it. It is very helpful to me as an accounting student

An excellent way to teach. I am trying to know accounting from level one and find it interesting.

Thank you so much for creating like this course for student which is very helpful to us .

Thanks a lot, I am coping up with Dr & Cr how to identify the transaction.