Accounts payable turnover ratio

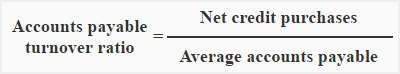

Accounts payable turnover ratio (also known as creditors turnover ratio or creditors’ velocity) is computed by dividing the net credit purchases by average accounts payable. It measures the number of times, on average, the accounts payable are paid during a period. Like receivables turnover ratio, it is expressed in times.

Formula:

In above formula, numerator includes only credit purchases. But if credit purchases are not known, the total net purchases should be used.

Average accounts payable are computed by adding opening and closing balances of accounts payable (including notes payable) and dividing by two. If opening balance of accounts payable is not given, the closing balance (including notes payable) should be used.

Example:

P&G trading company has good relations with suppliers and makes all the purchases on credit. The following data has been extracted from the financial statements of P&G for the year 2012 and 2011:

- Purchases during 2012: $220,000

- Purchases returns during 2012: $20,000

- Accounts payable on 31 December, 2011: $40,000

- Accounts payable on 31 December, 2012: $20,000

- Notes payable on 31 December, 2011: $8,000

- Notes payable on 31 December, 2012: $12,000

Required: Compute accounts payable turnover ratio (creditors’ velocity).

Solution:

= $200,000* / $40,000**

= 5 times

It means, on average, P&G company pays its creditors 5 times in a year.

* $220,000 – $20,000

** [($40,000 + $8,000) + ($20,000 + $12,000)] / 2

Significance and Interpretation:

Accounts payable turnover ratio indicates the creditworthiness of the company. A high ratio means prompt payment to suppliers for the goods purchased on credit and a low ratio may be a sign of delayed payment.

Accounts payable turnover ratio also depends on the credit terms allowed by suppliers. Companies who enjoy longer credit periods allowed by creditors usually have low ratio as compared to others.

A high ratio (prompt payment) is desirable but a company with shortage of cash should avail the full credit period allowed by its suppliers as it would hep the company manage its cash flows.

Leave a comment