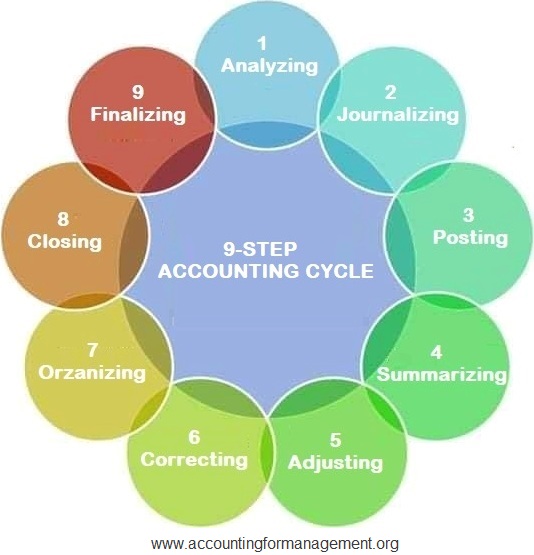

Steps in accounting cycle

Definition and explanation:

The accounting cycle, also known as the accounting process or bookkeeping process, is the start-to-end process that is followed sequentially, or at times, simultaneously, for recording the financial and accounting events that occur in a business organization.

In earlier times, these steps were followed manually and sequentially by an accountant. But these days, many software programs, like Tally, SAP, ERP, etc., complete all the steps involved in the accounting cycle simultaneously, and the user just needs to initiate the process by providing the relevant financial data.

Steps in accounting cycle:

A typical accounting cycle is a 9-step process, starting with transaction analysis and ending with the preparation of the post-closing trial balance. Let’s briefly look into each of these nine steps one by one.

1. Analyzing:

The first step of the accounting cycle is to analyze each transaction as it occurs in the business. This step involves determining the titles and nature of accounts that the transaction will affect. Each business transaction must be properly analyzed so that it can be correctly recorded in the journal.

2. Journalizing:

After determining the accounts involved, the next step is to journalize the transaction in a journal book. This book is also called the book of original entry because this is the first record where transactions are entered. In a journal, the transactions are entered in a chronological order, i.e., as and when they happen in business. A journal is prepared on the concept of a double entry system of accounting, where every transaction affects at least two accounts, i.e., a debit to one account and a corresponding credit to another account.

3. Posting:

Posting is the process of forwarding journal entries from journal book to ledger book, commonly known as general ledger. After journalizing, the accounting transactions are posted to their relevant ledger accounts. This step classifies and groups all entries relating to a particular account in one place. For example, all entries relating to sales are recorded in the sales account. Similarly, all transactions resulting in inflow and outflow of cash are entered in the cash account.

4. Summarizing:

This step summarizes all the entries recorded by the business during a particular period, which is generally the financial year of the entity. It is done by preparing an unadjusted trial balance – a list of all account titles along with their debit or credit balances. The unadjusted trial balance provides an overview of various types of financial transactions that the entity has undertaken and booked during the period.

The main purpose of drafting an unadjusted trial balance is to check the mathematical accuracy of debit and credit entries recorded under previous steps. The total of the debit column and credit column of the trial balance must be the same; remember the rule from the accounting equation that for every debit entry there must be a corresponding credit entry.

5. Adjusting:

After preparing the unadjusted trial balance, the next step is to pass journal entries pertaining to certain adjustments like recording of closing stock, prepaid expenses, outstanding expenses, accrued income, etc. These journal entries are known as adjusting entries, which ensure that the entity has recognized its revenues and expenses in accordance with the accrual concept of accounting.

6. Correcting:

After the adjusting entries have been passed and posted to respective ledger accounts, the unadjusted trial balance needs to be corrected to show the impact of these adjustments. For this purpose, an amended trial balance, known as an adjusted trial balance, is prepared.

7. Organizing:

The next step of the accounting cycle is to organize the various accounts by preparing two important financial statements, namely, the income statement and the balance sheet. The income statement lists all expenses incurred as well as all revenues collected by the entity during its financial period. These expenses and revenues are compared to reveal the net income earned or net loss sustained by the entity during the period.

The balance sheet is a depiction of the financial position of the business entity. It displays the assets owned by the entity, liabilities owed to creditors, and owner’s capital/equity at the date of its preparation.

8. Closing:

After preparing the income statement (or profit and loss account) and balance sheet, all temporary or nominal accounts used during the financial period are closed. This is done by means of specific journal entries known as closing entries. The closing step impacts only temporary accounts, which include revenue, expense, and dividend accounts. The permanent or real accounts are not closed; rather, their balances are carried forward to the next financial period.

9. Finalizing:

The ninth and last step of the accounting cycle is to prepare a final trial balance, which shows how the balances of various accounts have been affected by the entries recorded throughout the period under the above steps.

This final trial balance is generally referred to as the post-closing trial balance. Its format is similar to that of an unadjusted and adjusted trial balance. However, it lists only permanent accounts because all temporary accounts get closed in step 8 above. The post-closing trial balance serves as the base or opening trial balance for the next period’s accounting cycle.

Dear Sir/Madam,

With great regret and glad your site provided basic to advance accounting information to the visitor. I request you to pls send updated account and finance terminology with example on the below email id.

Thank You Very Much Teaching me!!