Statement of retained earnings

Definition and explanation

The statement of retained earnings is a financial statement that summarizes the changes in the amount of retained earnings during a particular period of time.

Retained earnings is the portion of net income that a company does not distribute among its shareholders but retains in the business for various purposes, such as growth of the business in the future and meeting the debt obligations, etc. It increases when the company earns net income and decreases when it incurs net loss or declares dividends during the period. Retained earnings appear in the balance sheet as a component of stockholders equity.

The statement of retained earnings is prepared after the preparation of the income statement but before the preparation of the balance sheet because it is used to compute the amount of retained earnings balance at the end of the period, which is finally reported in the entity’s balance sheet.

The computation of the retained earnings figure at the end of a period can be shown in the form of the following formula or equation:

Retained earnings at the end = Retained earnings at the beginning + Net income – Dividends

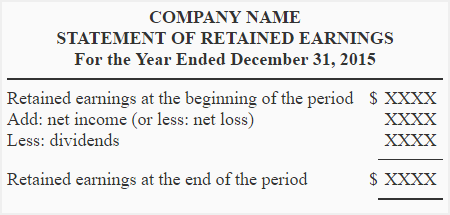

Format of the statement of retained earnings

A simple format of statement of retained earnings is given below:

In the above format, the heading part of the statement is somewhat similar to that of an income statement. It consists of three lines. The first line exhibits the company name to which the statement belongs; the second line shows the statement name, which is obviously the statement of retained earnings; and the third one tells users about the time span for which the financial statements are being prepared. This time span may consist of a quarter, a six-month period, or a complete accounting year.

Notice that the content of the statement starts with the beginning balance of retained earnings. The net income is added to and the net loss is subtracted from the beginning balance; the amount of dividends declared during the period (paid or not) is also subtracted in the statement of retained earnings. The resulting figure is the balance of retained earnings at the end of the period that should appear in the stockholders’ equity section of the entity’s balance sheet.

Examples

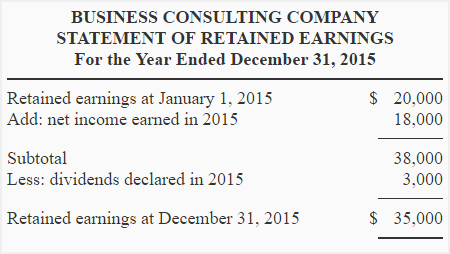

Example 1

The adjusted trial balance and the income statement of Business Consulting Company are given in the income statement article. Using that information, we can prepare the statement of retained earnings of the company as follows:

Notice that the opening balance of the retained earnings account in the above example is $20,000, which increases to $38,000 as a result of net income earned for the year 2015 and then reduces to $35,000 because of the distribution of the $3,000 dividend. When Business Consulting Company will prepare its balance sheet, it will report this ending balance of $35,000 as part of stockholders’ equity. You can see this presentation in the format section of the next page of this chapter – the balance sheet.

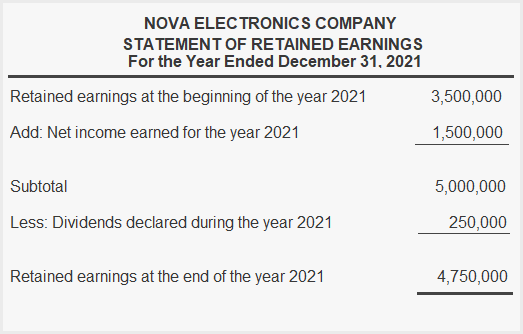

Example 2

Nova Electronics Company earned a net income of $1,500,000 for the year 2021. The retained earnings account balance as per adjusted trial balance of the company was $3,500,000. During the year, the company declared and paid a dividend of $250,000 to its stockholders. On January 1, 2021, Nova had 500,000 shares of $10 par value common stock and 50,000 shares of $100 par value preferred stock outstanding. The number of shares remained unchanged throughout the year, as Nova did not make any new issues during 2021.

Required: Calculate the balance of the retained earnings account that the company should report in its balance sheet as on December 31, 2021.

Solution:

The examples are very helpful.

Very good and easy to understand.