Exercise-5: Cash paid to suppliers – T-accounts approach

Learning objective:

This exercise illustrates the use of the T-accounts approach for computing the cash paid to suppliers of inventory (also known as trade creditors).

In exercise 4, we used the formula approach to compute the net cash paid to suppliers of merchandise. A more conceptual approach is, however, to use T-accounts for this purpose. In this exercise, we will use the data similar to exercise 4 and work out the total cash paid to suppliers using the T-accounts approach.

Exercise-5 (a):

Consider the following information of a merchandising company for the year 2023:

- Inventory on January 1, 2022: $40,000

- Inventory on December 31, 2022: $75,000

- Accounts payable on January 1, 2022: $22,000

- Accounts payable on December 31, 2022: $35,000

- Cost of goods sold for the year 2022: $350,000

Required: Work out the total cash paid to suppliers during the year 2023 by preparing T-accounts.

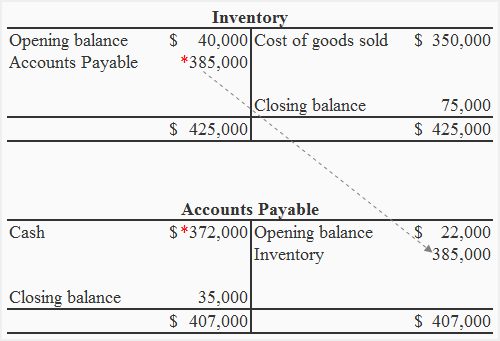

Solution:

*These are balancing figures and have been computed as follows:

Accounts payable:

= (350,000 + 75,000) – 40,000

= 385,000

Cash:

= (22,000 + 385,000) – 35,000

= 372,000

The cash paid to suppliers during the year 2023 was $372,000.

Exercise-5 (b):

Watson Company provides you the following data for the most current period:

- Inventory at the start of the period : $40,000

- Inventory at the end of the period: $32,000

- Accounts payable at the start of the period: $29,000

- Accounts payable at the end of the period: $15,000

The cost of goods sold (COGS) for the current period is $145,000.

Required: Compute the amount of cash paid for the purchase of merchandise inventory during the period using t-accounts approach.

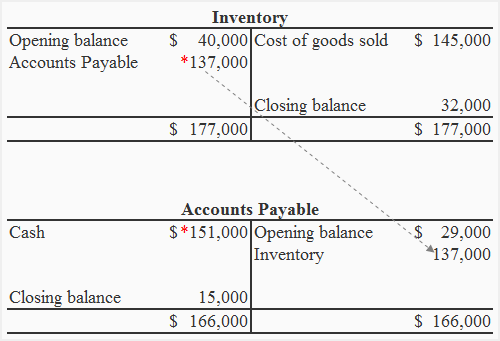

Solution:

*These are balancing figures and have been worked out as follows:

Accounts payable:

= ($145,000 + $32,000) – $40,000

= 137,000

Cash:

= ($29,000 + $137,000) – $15,000

= $151,000

Western Company paid $151,000 cash to its suppliers during the period.

Educative content thanks